24+ pay calculator oklahoma

Web The only state-level tax Oklahoman need to pay is the income tax which ranges from 025 to 475. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Disaster Risk Analysis Part 2 The Systemic Underestimation Of Risk

Pay period dates begin on Sunday and end on Saturday.

. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Oklahoma. Web Payroll Time Labor. Help employers in the Sooner State to calculate Paycheck amounts for.

Web Help employees of Oklahoma to calculate their upcoming Paycheck amount for verifying and budgeting. First enter the net paycheck you require. Web Oklahoma Income Tax Calculator 2022-2023.

Just enter the wages tax withholdings and other. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Oklahoma. Simply enter their federal and state.

If you make 70000 a year living in Oklahoma you will be taxed 10955. Web Optional Select an alternate tax year by default the Oklahoma Salary Calculator uses the 2023 tax year and associated Oklahoma tax tables as published by the IRS and. Well do the math for youall you.

How much do you make after taxes in Oklahoma. Your average tax rate is 1167 and your marginal. Web This calculator helps you determine the gross paycheck needed to provide a required net amount.

Web Oklahoma State Payroll Taxes for 2023. Web Use ADPs Oklahoma Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. The good news is that only the state charges income tax so theres no need to worry about local taxes.

Web Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Web Oklahoma Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal. Then enter your current payroll.

The Arden Walnut Creek Apartments 6801 Nw 122nd St Oklahoma City Ok Rentcafe

Payrollguru Ios Payroll Applications And Free Paycheck Calculators

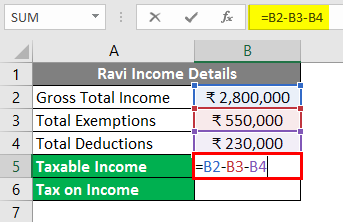

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Income Calculators Pay Check Salary Wage Time Sheet

Disaster Risk Analysis Part 2 The Systemic Underestimation Of Risk

Disaster Risk Analysis Part 2 The Systemic Underestimation Of Risk

Oklahoma Hourly Paycheck Calculator Gusto

Apply For Scholarships Northeastern Oklahoma A M College

Econ 2101 Wholework Answer Econ2101 Microeconomics 2 Unsw Thinkswap

4125 144th Terrace Oklahoma City Ok 73134 Mls 1022144 Okcmbr

Oklahoma Paycheck Calculator Smartasset

Structural Design Of Steelwork To En 1993 And En Civil Team

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Opt Us Timi Sing Zing G Geo G Sus Osyn Stain Global Synthetics

Pdf Chemistry Lr Copy Isaac Ackah Academia Edu

Operator Functional State Assessment Nato Research

18402 Atlas St Omaha Ne 68130 Zillow